Health insurance is a way to help you pay for your medical and health needs.

It’s also a protection plan in case you get seriously ill or injured.

The first thing to know is that each plan is different, and what’s right for your

neighbor may not be right for you and your family.

Current Health Insurance Options

- On-Exchange (Marketplace) or Obamacare with a subsidy

- Off-Exchange (Off Marketplace) or Obamacare without a subsidy

- Short-Term Medical

- Indemnity Plans

- Healthcare Ministry (Medical Expense Sharing Program)

WORDS TO KNOW

- Premium – The amount you pay each month to have health insurance coverage. This is like a membership fee that you pay, whether you use your insurance or not.

- Deductible – The amount you pay for healthcare services before your insurance plan begins to pay.

- Copay – A fixed amount (for example, $30) that you pay every time you use healthcare services, like doctor visits and prescriptions.

- Coinsurance – A fixed percentage of the total bill (for example, 20%) that you are responsible for paying. The remainder of the total bill (for example, 80%) will be covered by your health insurance.

- Out-of-pocket expense – Your healthcare costs that are not covered by your insurance plan, such as deductibles, copays, and coinsurance.

On-Exchange (Marketplace) or Obamacare – with a subsidy

Open Enrollment for 2024 coverage is November 1, 2024, through January 15, 2025.

- Enroll by December 15, 2024, for coverage starting January 1, 2025.

- After January 15, you can enroll in 2025 health insurance only if you qualify for a Special Enrollment Period.

Special Enrollment Period (SEP)

A time outside the yearly Open Enrollment Period when you can sign up for health insurance. You qualify for a Special Enrollment Period if you’ve had certain life events, including losing health coverage, moving, getting married, having a baby, or adopting a child.

If you qualify for an SEP, you usually have up to 60 days following the event to enroll in a plan. If you miss that window, you have to wait until the next Open Enrollment Period to apply.

You can enroll in Medicaid and the Children’s Health Insurance Plan (CHIP) any time of year, whether you qualify for a Special Enrollment Period or not.

Job-based plans must provide a special enrollment period of at least 30 days.

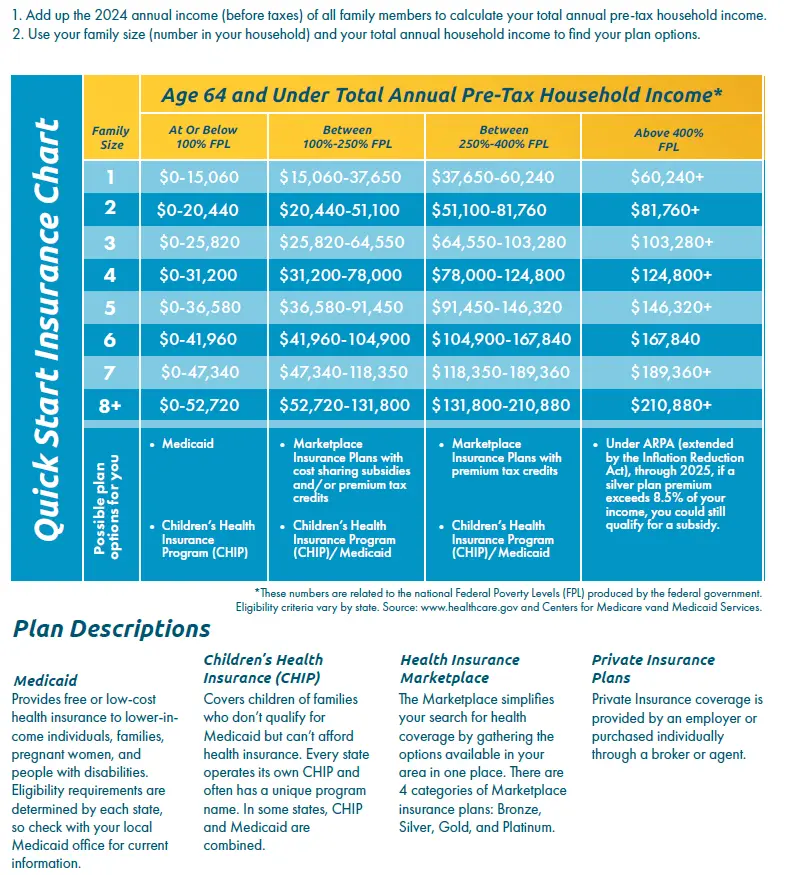

Subsidy Chart

(click to enlarge the chart above)

Off-Exchange (Off Marketplace) or Obamacare – without a subsidy

The main difference between On and Off Exchange plans is the price

Short-Term Medical

These plans offer lower premiums and more flexibility than ACA plans, but do not cover preexisting conditions.They are not considered a qualified health plan,

Short-Term Medical is the choice for many Americans, who do not qualify for a subsidy on the ACA plans, and who find themselves in a coverage gap in the 18 states who opt not to accept federal funding to expand Medicaid.

Coverage is quick. Typically, plans start immediately.

There’s more flexibility for doctors and hospitals.

The cons? Any medical condition that comes up during the term of the plan, is not able to be covered in your next short-term plan.

Indemnity Plans

What is an Indemnity Plan?

Indemnity plans are the most flexible option and allow you to visit any doctor or hospital for your health services. So, Once you submit the bill to the insurance company, the carrier pays a fixed amount of your charges. So, this “fee plan” or “fee-for-service” plan offers the most flexibility of any other health plan.

How does it work?

With an Indemnity plan, you can see whatever doctors you like, without a referral. Plus, you are not forced to have a primary care physician, and you can go straight to the specialist you need to see. Therefore, it saves time and money for everyone involved. Indemnity plans usually require you to pay for your doctor bills up front, submit a claim to the insurance company, and wait for reimbursement.

Most indemnity plans also have a deductible before claims will be paid. And once your deductible is met, the insurance company pays your claims at a set percentage of the service, as long as it is at a “usual, customary and reasonable (UCR) rate” for that particular service. The UCR rate can be defined as, “the typical amount healthcare providers charge for a service in your area”.

This plan may be perfect for you if:

- The greatest level of freedom is important to you, when choosing your doctors and hospitals.

- It’s important for you to visit any doctor you choose.

- You don’t want to be forced to visit a primary care doctor just for a referral to go to the doctor you need.

Healthcare Ministry (Medical Expense Sharing Program)

However, with a share program, each month your monthly share is matched with another member’s eligible medical bills. You pledge a certain amount towards others and , in turn, they pledge an amount. All of this is shared among the group, so that no one family has an unbearable burden. So that’s how it is supposed to work. However, there are no contracts and they are not obligated to pay for any of your medical bills. Also, they either don’t allow for pre-existing conditions or it takes years for a condition to be covered, if you’ve had a treatment for it before joining.