Acronyms are everywhere in health insurance, and unless you know what they stand for, trying to understand insurance quickly turns into translating hieroglyphics. Take, for instance, the commonly used terms “HMO” and “PPO.” What do they mean?

We consulted with Jeff Hess, Empower Brokerage’s Individual Health Insurance and ACA Specialist, to understand these terms and the major differences.

According to Jeff, “PPO” stands for Preferred Provider Organization, and “HMO” stands for Health Maintenance Organization. Both are types of health insurance plans with different benefits. Usually, the primary thought when comparing these two terms concerns their differing prices. Generally, a PPO is more expensive than an HMO. We’ll cover more on that here in a second.

In-Network and Out-of-Network

Two terms crucial to understanding HMO and PPO plans are “in-network” and “out-of-network.” Doctors and their staff, urgent care facilities, hospitals, and insurance companies will form close-knit healthcare teams known as networks. The participants within these networks will prioritize each other’s businesses by referring patients to one another, working together to streamline their procedures, sharing best practices, and more. Being part of a network legitimizes one’s medical practice and opens doors for new and diverse patients to get treatment.

With an HMO, doctors expect patients to seek treatment only from the doctors and facilities teamed up with their provider or the ones “in-network.” These networks may be small, meaning your choices are limited in who can treat you, even in emergencies. If you go “out-of-network” and visit an office or ER outside of your plan, your insurance will not help pay for the cost of your treatment. Benefits are in-network only.

With a PPO plan, patients may choose to see doctors or visit facilities that are either in-network (teamed up with their insurance provider) or out-of-network (on a different team than their insurance provider). The benefit of a PPO plan is that networks are typically more diverse, and your insurance will help pay for your care no matter who you see or where you go. You can get treated almost anywhere, and rest assured you will be covered. You may pay more for out-of-network care than in-network care, but you’ll still receive help from your insurance company.

Choosing a Primary Care Physician

Another significant difference between HMO and PPO plans is the implementation of primary care physicians, otherwise called PCPs. PCPs receive training to examine patients generally, doing whole-body check-ups to glean information. After a holistic examination, they coordinate care between patients and specialists to ensure specific ailments are addressed.

If you have an HMO plan, you are required to have a PCP. From the moment of application, your PCP becomes your doorway to receiving health treatments. To be covered, you must make an appointment with your PCP when you first notice an issue or illness. From there, they’ll perform an examination and, based on their deductions, will provide general treatment or refer you to an in-network specialist for further care. Specialists are doctors whose focus lies in a specific field or area of the body. Some examples are pediatrists (foot doctors), cardiologists (heart doctors), gastroenterologists (digestion doctors), and dermatologists (skin and hair doctors). In many cases, a written or electronic referral from a PCP is a prerequisite to receiving any specialist treatment.

If you have a PPO plan, you do not have to have a PCP. You can see any provider that you want, wherever you want. Copay and co-insurance rates will vary based on whether you go in-network or out-of-network for your care, but your insurance will kick in no matter what. Again, the tradeoff for flexible, speedy, specific care is that PPOs are much pricier than HMOs.

Conclusion

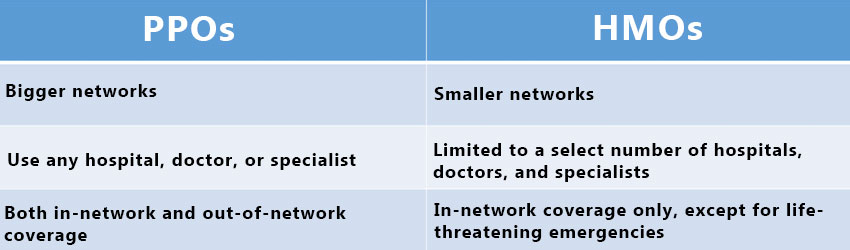

The table above highlights the main differences between PPOs and HMOs and why their prices vary so much.

Now, when we’re talking about the Affordable Care Act/Obamacare and the insurance industry at large, the carriers primarily selling HMOs (in most states) are losing less money than the companies primarily selling PPOs. The reason for that is treatments cost less in an insular network. Business refers to other businesses, patients stay in the network, and returns are pretty much guaranteed. With PPOs, the freedom given to patients to go anywhere makes financial security for health-based businesses more elusive.

Many carriers have moved away from offering PPO plans because they can’t control costs. It says it in the newspapers and is out there in the media– insurance companies are losing hundreds of millions of dollars on the Affordable Care Act for individual health. So, PPOs are harder to find. Most carriers are moving to favor HMOs.

Have Health Insurance Questions?

We hope that this information on HMOs and PPOs has been helpful for you.

Insurance is oftentimes overwhelming, and we want to shed light on the industry by answering your questions. Comment below and your question may be the topic of our next post!

If you liked this article, share it with your friends!

Empower Brokerage wants to help you find the insurance coverage you need and help you save money getting it. Stay on top of your health and give us a call at (844) 410-1320.

Get affordable health insurance quotes by clicking here.

See our other websites:

This article was updated on 3/19/24.